There were many valuable lessons learnt from my trading journey tbh.

- Buy during fear and sell euphoria

- Learn TA (Extremely valuable skill)

- Learn to identify narrative and hidden gems (Gotta camp on CT for 2 years like me to be able to discern for yourself, no way around it only hardwork tbf)

- TAKE PROFITS (I always make it as an absolute rule to take 50% out when 2x unless long term hold where I will still take profits but close to ATH)

- Always have a plan and follow it strictly especially your exit targets, it’s easy to be caught up in euphoria hence a plan helps to keep your emotions in check.

- Stay curious as curiosity will always be your edge.

My journey so far..

- Invested a small amount slowly in 2021 (July I think)

- Slowly watched my PF 3-5x and thought that I was a genius!

- Then got excited and invested a significant amount of money (for me)

- Got rekted till -85% I think (During 2022)

- Deposit $50 for trading and brought it up till $500

- Lost it all in the FTX debacle

- Deposited 100-200 again and slowly traded it.

- Got lucky during the mini bull run alt in different chain (Sol, BSC, etc)

- Rotated quickly and try to sniff out narratives and be early to it

- Off-ramped 80% of portfolio, not willing to give it back.

- Aiming to re-trade everything again from 20% of portfolio but with significant lesser downside

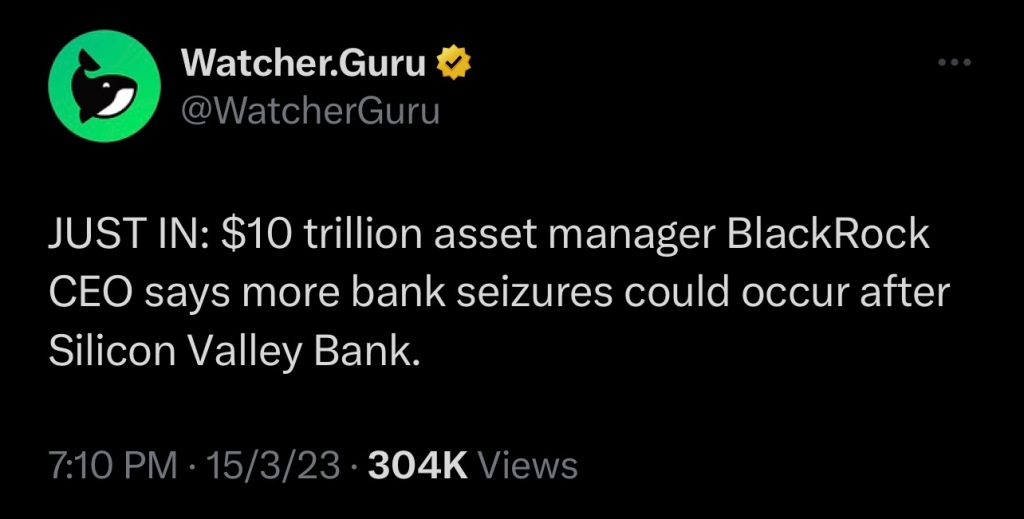

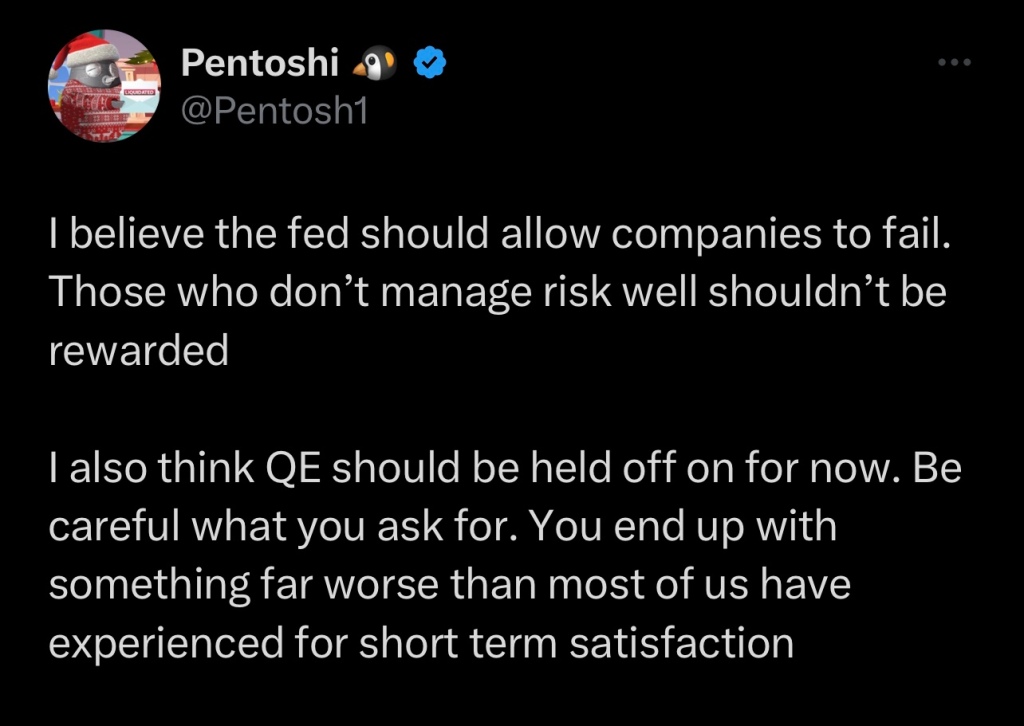

As I have said before, you have a small PF, leverage trading may not be for you. It is pret slow tbh and you have to really manage your risk well. Hence shitcoin trading will be the next best alternative imo. Have to go to the extreme end of the risk curve for those large multiples.. No other way around it imo.

This post is just solely for my reflection & hopefully y’all will be able to gain some insights from it. Just wanna say that it is POSSIBLE to recover your portfolio and this post is a good example of it, BUT it will require tremendous amount of effort.. You know where to reach me if you need resources. ATB anons!