Remember those days where metaverse coins were making an ez 2-3x within 2-3days? Or when FTM ecosystem was making 10-20x across the board? Meme coins mooning without any fundamentals?

Now remember the pain where BTC dropped from 69k till 16k and all our fav alts dipped 90-100%.

Now consolidate all your thoughts process, sieve through every single event and how you felt. Why didn’t you take profits? Why didn’t you go on defensive mode?

Does it help to form some sort of structure or objectives where you can follow in the future?

If so, what is the best way to position yourself to enjoy the best returns? Are you still bullish on your alts? If so, why? What is your thesis?

Fundamentals in Crypto is BS imo.

My stance has changed because I have expanded my knowledge and understood just alittle more compared to 6 months ago. Still lots of room for improvement. But wouldn’t change a single thing.

This bear market has been painful but it has also taught me many valuable lessons. Nothing beats cash. There’s no difference in tradfi and crypto. There will always be market markers and people that can move the market. Key is to follow the flow.

The only way to make money is to follow the trend/flow unless you have enough capital to disrupt the trend. It’s always wise to follow the trend.

Gone were the days where mega tradfi companies can take advantage of normies like us. GameStop saga has been a clear example. The power of many normies combined can be pretty lethal. Attention and identifying narrative plus taking profits is really what you need.

Identify your edge and keep rinsing it. It’s normal if you’re losing money when learning how to trade in these nasty conditions. Once you’ve hone these skills, an average trader/investor that takes healthy profits can make decent profits.

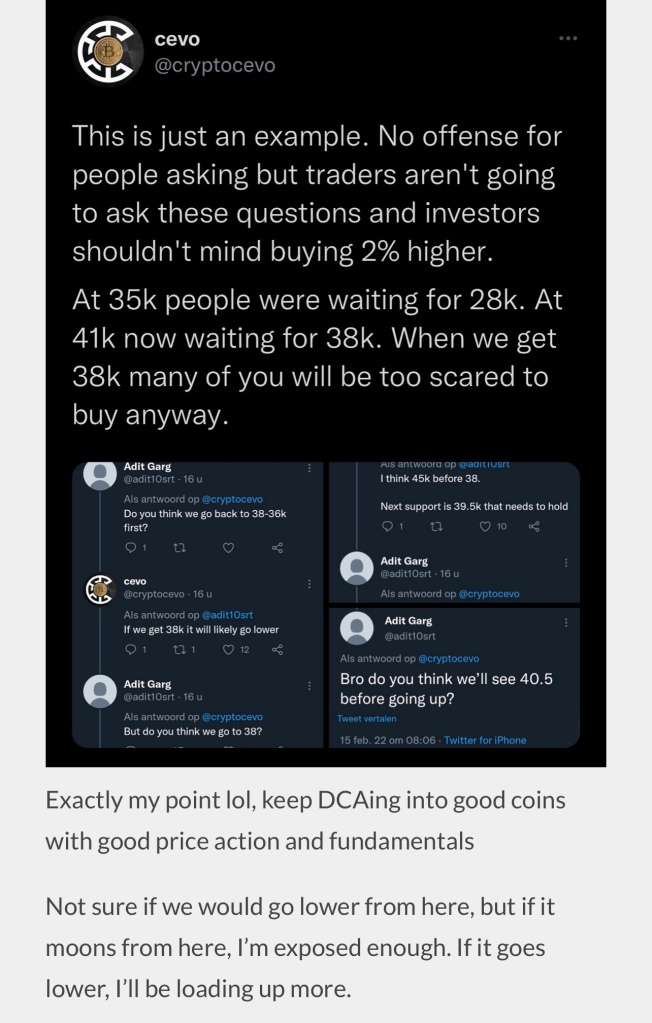

I’ve always thought that DCAing is a decent option. Tbh, I’m still applying this approach. But I would prefer the dynamic DCA approach. Helps to preserve alil more capital while still keeping some skin in the game.

I would suspect that mid 2023 will bring on beautiful buying opportunities. Mid 3 figures ETH remains the dream. If we do get it, y’all should know what to do.

Buying ETH is literally like buying an index on steroids. This could very well be the last market cycle with 10-20x. As more tradfi companies comes in to participate, the harder it will be to extract money from the market.

So put in what you can afford to lose, should be a comfortable amount where you can still enjoy the perks of a moon scenario.

Lengthy post, prolly will stop here. Merry Christmas anons! 🎄🎄